This month, new additions to the project tracker include two significant ventures: a $1.4 billion sodium-ion battery factory in Rocky Mount, North Carolina, and a $575 million semiconductor facility in Taylor, Texas.

The manufacturing sector in the U.S. has seen a remarkable surge in investment since the CHIPS Act was signed into law in August 2022. This legislation has catalyzed a wave of projects ranging from semiconductor fabrication plants and electric vehicle battery production facilities to consumer goods manufacturing and automotive assembly plants.

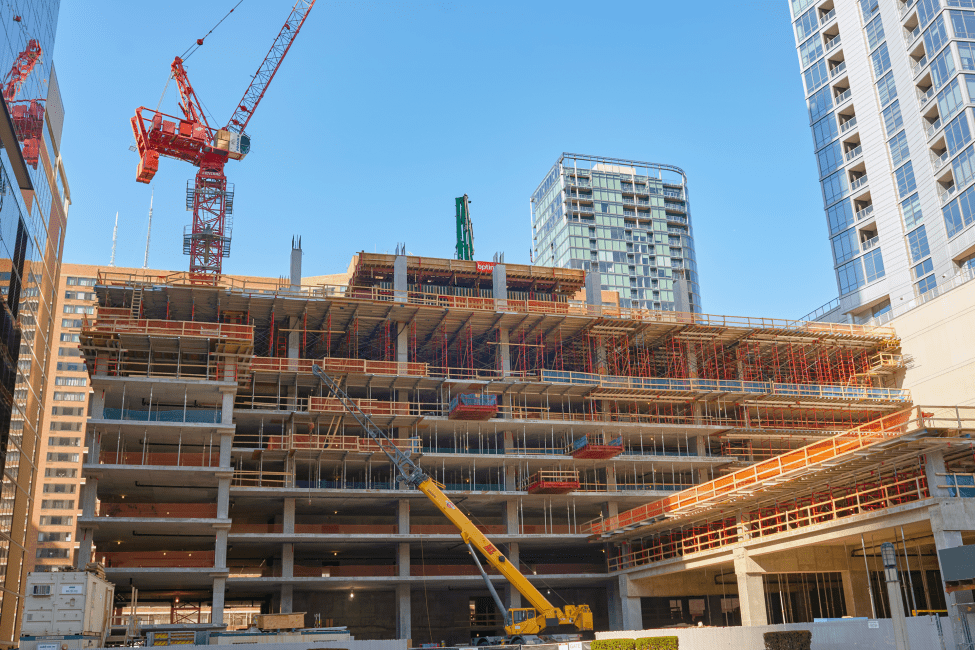

To keep you updated on this booming sector, Construction Dive has compiled a list of the largest manufacturing projects announced since the CHIPS Act’s inception. These projects are categorized by value and location, with details on their contractors when available. Regular updates will be provided to ensure you have the latest information.

The U.S. has made significant strides in reclaiming its position in global manufacturing, one year after President Joe Biden enacted the $52 billion CHIPS and Science Act. This renewed focus on revitalizing domestic manufacturing, after decades of offshoring, has resulted in an impressive $898 billion in private sector investments, according to the White House. These investments are spread across the country, covering diverse industries such as biotechnology, semiconductor production, electric vehicle batteries, and clean energy projects.

Some of the major manufacturing projects recently added to this tracker include:

- A $1.4 billion Natron Energy manufacturing facility in Rocky Mount, North Carolina.

- A $680 million LS GreenLink project in Chesapeake, Virginia.

- A $575 million Soulbrain TX semiconductor plant in Taylor, Texas.

The project map also highlights the contractors involved when available. Notable recent contract awards include:

- Taunton Development Corp. Construction’s win on Rhino Capital’s $11.5 million manufacturing facility in Taunton, Massachusetts.

- Force Construction’s contract for Toyota Material Handling’s $100 million project in Columbus, Indiana.

Manufacturing construction across the U.S. has been on an upward trajectory. According to an analysis by the Associated Builders and Contractors, manufacturing construction spending saw a 19.1% increase over 12 months through June, with a seasonally adjusted annual rate of approximately $235.53 billion in June.

The momentum in manufacturing is largely attributed to the 2022 CHIPS Act, which allocated $52.7 billion for American semiconductor research, development, manufacturing, and workforce initiatives. This includes $39 billion in manufacturing incentives, $2 billion specifically for legacy chips used in automobiles and defense systems, $13.2 billion for research and workforce development, and $500 million aimed at strengthening global supply chains. Additionally, the CHIPS Act offers a 25% investment tax credit for capital expenses related to semiconductor manufacturing and associated equipment.

As noted by industry experts, the influx of public funding into the manufacturing and infrastructure sectors has driven significant growth over the past year. Looking ahead, several mega-manufacturing projects are expected to break ground, keeping the sector’s momentum strong and ensuring elevated construction starts for the foreseeable future.